As the Democratic Republic of Congo (DRC) navigates ongoing turmoil in its eastern regions, China continues to deepen its strategic partnerships in the country’s vast mineral wealth, outpacing U.S. efforts that appear hampered by a stalled peace agreement brokered by President Donald Trump.

While Trump’s June 2025 mediation between DRC and Rwanda was hailed as a breakthrough, persistent fighting and unfulfilled commitments have undermined its effectiveness, allowing Beijing to solidify its influence in critical sectors like cobalt and copper mining

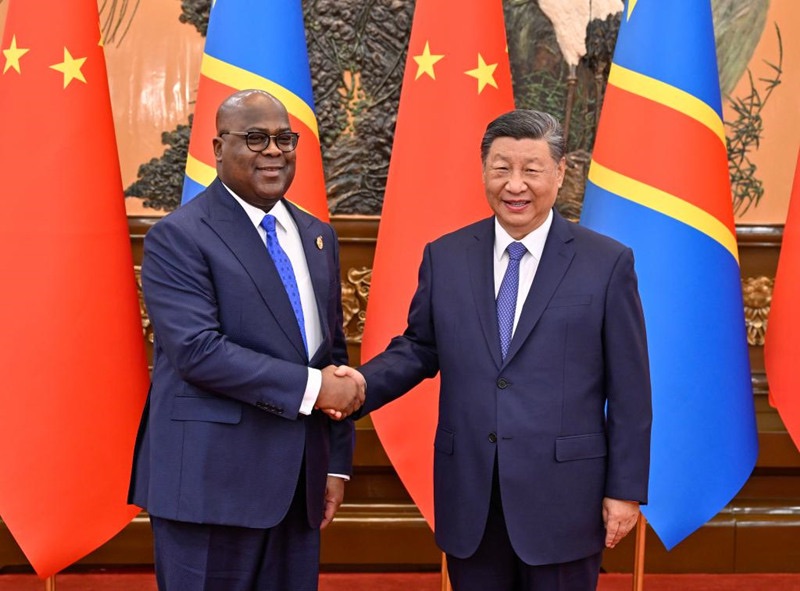

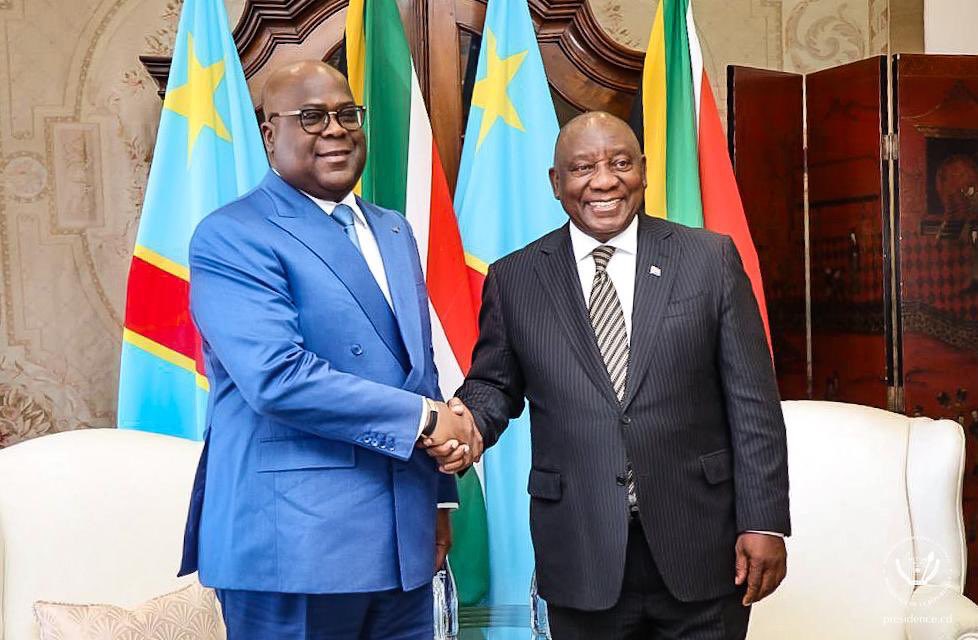

Signed on June 27, 2025, in Washington, the agreement aimed to end Rwanda’s alleged support for the M23 rebel group in eastern DRC, with a 90-day implementation deadline extending into September. Trump described it as a “wonderful treaty,” but on-the-ground realities tell a different story. DRC President Felix Tshisekedi has publicly noted that violence has not abated, accusing Rwanda of feigning troop withdrawals while bolstering M23 forces. As of early September, joint oversight meetings reaffirmed commitments to cease support for armed groups, yet reports from the region indicate continued clashes and missed deadlines, including a prior August ceasefire failure.

This instability has broader implications for U.S. interests. The deal was partly framed as a pathway to secure American access to DRC’s minerals, essential for green energy and technology. However, Tshisekedi has firmly rejected any notion of “auctioning” these resources to the U.S., emphasizing instead equitable partnerships focused on infrastructure and value chains. Negotiations for a U.S.-DRC strategic minerals deal remain ongoing but sparse on details, overshadowed by the peace accord’s shortcomings. Critics argue that tying mineral access to security guarantees has backfired, as persistent conflict deters Western investors already wary of the region’s volatility.

n contrast, China’s engagement in DRC has been robust and longstanding, positioning Beijing as the dominant player in the mining sector. Chinese firms control up to 80% of cobalt production—the DRC supplies 80% of the world’s cobalt—and have secured major stakes in copper through infrastructure-for-minerals deals dating back to 2008. The Sino-Congolais des Mines (Sicomines) venture exemplifies this, exchanging mining rights for roads, highways, and hospitals, with recent expansions into additional projects.

DRC’s strategic partnership with China, formalized and active, contrasts sharply with the nascent U.S. talks. Beijing’s approach—focusing on direct investments without heavy security preconditions—has allowed it to weather regional conflicts, including those involving M23. In 2025 alone, Chinese operations in key mines like those in Peru and DRC have expanded, chasing cobalt and copper to fuel global green transitions. U.S. attempts to counter this, such as pressuring DRC to block Chinese acquisitions (e.g., Chemaf Resources in 2024), have yielded limited results, with China maintaining its grip on extraction, processing, and exports.

Moreover, amid the U.S. peace deal’s delays, China has capitalized on DRC’s need for stable partners. While American companies rush in post-accord, they face logistical hurdles and competition from entrenched Chinese entities, often taking over from Western firms deterred by instability. This dynamic underscores a broader U.S.-China rivalry in Africa, where Beijing’s pragmatic investments are yielding dividends as Washington’s security-linked strategies falter.

For the DRC, leveraging this competition could be advantageous, but current trends favor China. Tshisekedi’s administration seeks balanced deals, yet the peace deal’s erosion—coupled with sanctions on conflict mineral traffickers—highlights vulnerabilities that Chinese firms navigate more adeptly. Globally, this means continued reliance on Chinese-controlled supply chains for critical minerals, potentially amplifying Beijing’s geopolitical leverage.

As Trump’s accord teeters on the brink, China’s steady advances in DRC paint a picture of strategic foresight prevailing over diplomatic optimism. The coming months will test whether the U.S. can salvage its position or if Beijing’s dominance becomes unassailable.